You can ask our tax advisors an unlimited number of questions at no extra cost (excludes business returns).

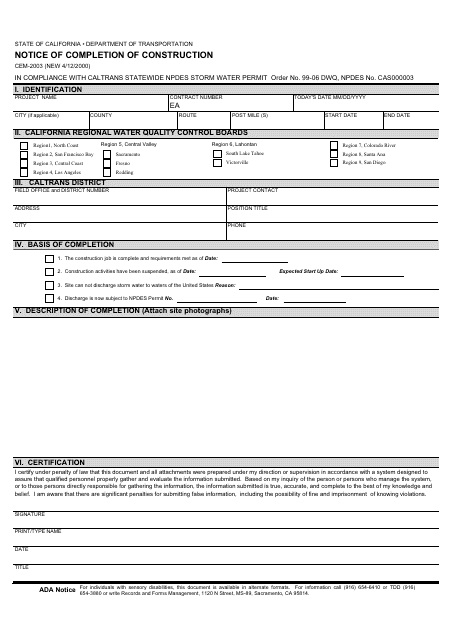

California notice of completion form z software#

California notice of completion form z pro#

If you need help navigating your state tax obligations, get help with H&R Block Virtual ! With this service, we’ll match you with a tax pro with California tax expertise.

It’s important to avoid state tax issues and potential financial liability for failing to pay taxes. Here are links to common California tax forms, along with instructions: 540 California Resident Income Tax Returnĥ40 2EZ California Resident Income Tax Return This form should be completed after filing your federal taxes, using Form 1040. This form is used by California residents who file an individual income tax return. The most common California income tax form is the CA 540. Common California Income Tax Forms & Instructions Ĭommonly used California income tax forms are also available at Franchise Tax Board offices, most public libraries, post offices, and other county offices. If you are trying to locate, download, or print California tax forms, you can do so on the state of California Franchise Tax Board website, found at. Read on to learn more about common California income tax forms, including CA 540.

And with that, comes completing and filing California tax forms. If you live in the state of California or earn income in the state, it’s likely you will have to pay California income tax.

0 kommentar(er)

0 kommentar(er)